First tax havens blacklist published by EU

The european union has posted its first blacklist of tax havens, naming 17 territories together with saint lucia, barbados and south korea.

A "watchlist" of 47 nations promising to change their tax guidelines to meet european standards has additionally been issued.

The "grey listing" consists of several with united kingdom hyperlinks, including hong kong, jersey, bermuda and the cayman islands, as well as switzerland and turkey.

Both lists had been criticised as omitting the most infamous tax havens.

The lists comply with the leaking of the panama papers and the paradise papers, revealing how corporations and individuals hid their wealth from tax authorities around the arena in offshore bills.

Eu tax commissioner pierre moscovici said the blacklist represented "full-size progress", adding: "its very life is an vital breakthrough. But because it's far the primary european list, it remains an insufficient response to the scale of tax evasion global."

How a good deal of the sector's wealth is hidden offshore?

Panama papers: complete insurance

To determine whether a country is a "non-cooperative jurisdiction" the eu index measures the transparency of its tax regime, tax fees and whether the tax system encourages multinationals to unfairly shift profits to low tax regimes to keep away from better responsibilities in other states. In particular these consist of tax systems that provide incentives which includes 0% company tax to foreign companies.

European individuals have been left to decide what motion to take in opposition to the offenders. Ministers dominated out implementing a withholding tax on transactions to tax havens in addition to other economic sanctions.

A few states, such as luxembourg and malta, hostile stricter sanctions, in step with officers. European fee vice-president valdis dombrovskis stated "more potent countermeasures might have been foremost".

Panama is one of the 17 countries listed by the ecu but its president, juan carlos varela, said the united states of america become "now not in any way a tax haven".The european is encouraging member states to take what it calls "protecting moves" against those countries that do not reform their tax systems.

The United Kingdom-based totally charity oxfam ultimate week posted its very own list of 35 international locations that it said should be blacklisted.

Oli pearce, oxfam's inequality and tax coverage advisor, stated: "it is worrying to see commonly small countries on the eu blacklist, whilst the most infamous tax havens - united kingdom-related locations like bermuda, the cayman islands, jersey and the virgin islands - escape with a place on the 'grey listing'.

"although we recognise that is a step inside the right course, if eu leaders allow too many tax havens off the hook we're going to all lose out. An area on the gray listing need to no longer imply tax havens get off scot-free."

But, tax campaigner richard murphy stated some countries on the gray list ought to nevertheless face heavy sanctions in the event that they failed to reform their tax structures.

He said european countries will be advocated to disallow payments made to those places for tax purposes, or to rate withholding taxes on interest payments to them.

That tactic should "thoroughly neuter their so-known as reputation as 'tax impartial global economic centres' with the aid of ensuring that all monies they acquire were taxed before getting there", mr murphy said.

"the eu is likewise pronouncing to the UK that it's miles taking real measures towards british distant places territories and crown dependencies, and the message is - if you pass the same way as them with a comparable low-tax regime after brexit, you'll be sanctioned too."the 17 blacklisted territories are:

American samoa

Bahrain

Barbados

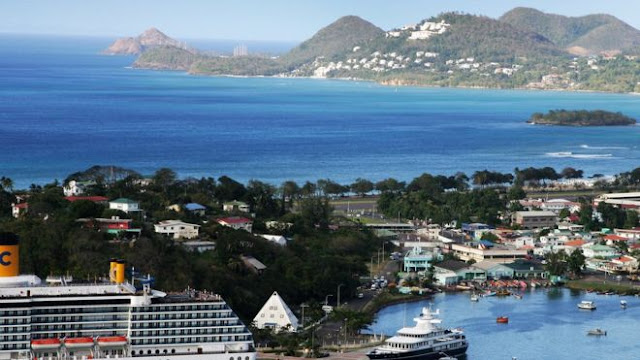

Grenada

Guam

South korea

Macau

The marshall islands

Mongolia

Namibia

Palau

Panama

Saint lucia

Samoa

Trinidad and tobago

Tunisia

United arab emirates

The eu made exceptions for nations confronted with natural failures consisting of hurricanes, and placed the procedure briefly on hold.